If you trade Bitcoin during choppy markets, you’ve probably considered parking value in Tether. For a hands-on route, start with exchange BTC to USDT — a quick way to swap BTC into stablecoins before volatility snowballs. From here on, let’s unpack what Bitcoin/Dollars actually means, when a Bitcoin to Dollars converter makes sense, and how to run the numbers with a BTC to USDT calculator (including fees and slippage).

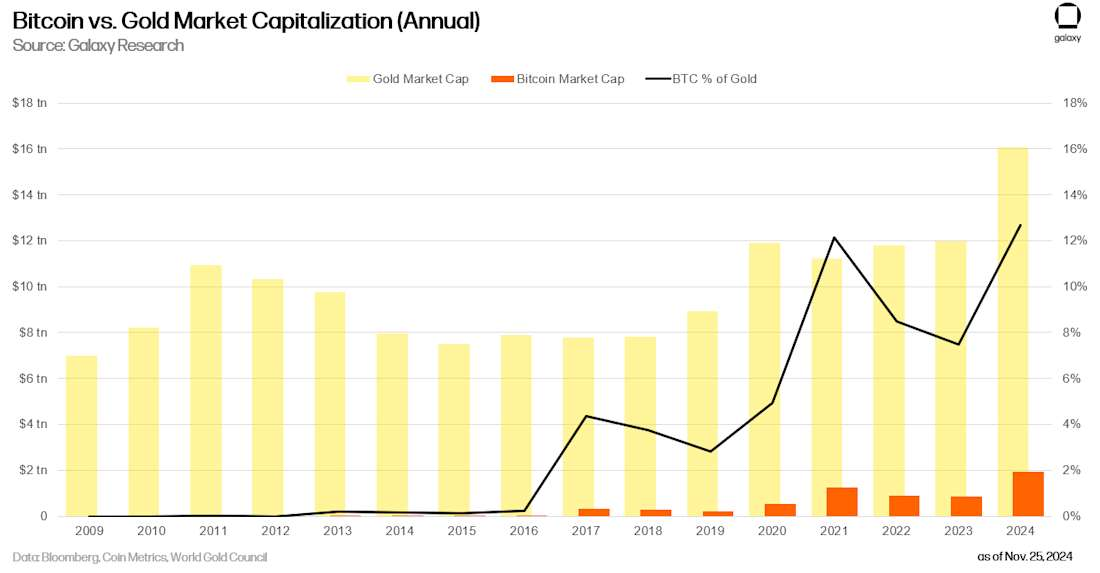

Chart showing Bitcoin vs. Gold market cap annually.

BTC/USDT Meaning

Bitcoin/Dollars is a trading pair: you’re pricing Bitcoin (BTC) in Tether (USDT), a dollar-pegged stablecoin. Instead of converting back to bank dollars, traders move into Dollars to hold near-USD value on-chain and jump back into risk assets quickly. In practice, “buying Bitcoin/USDT” means you’re exchanging Dollars for Bitcoin; “selling Bitcoin/Dollars” means you’re converting Bitcoin back to Dollars.

When to convert BTC to USDT

Converting isn’t “good” or “bad” by itself — it’s a tool. Use it strategically:

- Volatility spikes. If a sharp drawdown looks likely (macro event, regulatory headlines, thin liquidity), a swap BTC to USDT can preserve gains while you wait for clearer momentum.

- Portfolio rebalancing. Lock in profit after a run-up; redeploy later via staged buys.

- Cash-like needs. You plan to pay expenses in stablecoins or move funds between venues without touching fiat.

- Risk rules. Some traders auto-switch a portion of holdings to USDT when BTC loses a key moving average or breaks a support zone.

Quick sanity check: swapping too often can turn into performance drag via spreads, fees, and missing upside. Decide your triggers before price moves.

How to use a BTC to USDT Converter (Step by Step)

A converter bundles rate quotes, fees, and routing behind one interface. Here’s a simple flow that keeps you in control:

- Enter amounts. Pick Bitcoin to Dollars; type the BTC you want to sell.

- Pick rate type. Floating rates follow the market; fixed rates lock for a short window.

- Check effective rate. Compare the final USDT you’ll receive after fees and network costs.

- Paste the destination USDT address. Double-check the network (e.g., TRC20 vs ERC20) to avoid mis-sends.

- Send BTC to the provided address, then confirm USDT arrival in your wallet.

Most modern flows include a built-in Bitcoin to Dollars calculator that shows your expected USDT after fees — use it before committing.

Calculator vs Converter: What’s The Difference?

- A calculator is a planning tool. It estimates your USDT outcome, factoring the live rate and typical fees.

- A converter executes the trade. It also shows the estimate, but you still review networks, addresses, and confirmations.

Tip: run the calculator with a tiny test amount first; ensure timing and addresses are correct, then proceed with the full size.

Fees, Spreads, And Slippage — How They Affect Your Result

Before you hit “exchange,” it helps to understand where your dollars might leak:

- Spread: The gap between bid/ask or source quotes. Wider during volatile hours.

- Network fees: Miner/validator fees to move BTC and deliver USDT; vary by network load.

- Service fees: Platform markup for routing liquidity and handling settlement.

- Slippage: Price moves between quote and execution, especially for larger orders or thin books.

Chart showing monthly data from 2023 to 2025.

A good converter makes these costs transparent and gives you a realistic received USDT number up front. If you’re trading size, consider splitting into tranches across time.

Risk management for swaps

Even “stable” strategies need guardrails. Before you convert Bitcoins to Dollars, set:

- A thesis and a timer. Why are you swapping, and what gets you back into BTC?

- Position sizing. Decide the % you’ll hedge — not necessarily 100%.

- Network discipline. Confirm the chain (TRC20/ERC20/etc.) and do a small test send when switching wallets or venues.

- Custody hygiene. Prefer reputable platforms and secure wallets; keep long-term reserves off hot wallets.

For broader market context that can influence your timing, see: “Trump and Crypto: Market Impact” — policy shifts can change liquidity, sentiment, and even stablecoin behavior, which in turn affects BTC/USDT flows.

BTC to USDT: common use-cases with examples

To make the trade-offs concrete, here are scenarios where a converter shines:

- Day traders: Lock in daily gains — finish the session in USDT to start fresh tomorrow without overnight BTC risk.

- Arbitrage/hops: Move between venues fast in USDT, then back to BTC where prices are favorable.

- Buying the dip: Swap to USDT on breakdowns, set laddered buy orders lower, and let the market fill you.

- Expense planning: If you’re paying contractors or platforms in stablecoins, converting at once reduces repeated fees.

Quick troubleshooting

Even experienced traders make avoidable mistakes. A short checklist helps:

- Wrong network for the USDT address (e.g., sent to ERC20 while you entered TRC20). Always match network labels.

- Copy-paste errors. Use QR or double-confirmation; never type addresses manually.

- Unconfirmed BTC tx. During peak congestion, confirmations can lag; track the tx hash before contacting support.

- Over-swapping. Emotional trading can whipsaw you; pre-define re-entry logic.

FAQs

Is Tether “risk-free”?

No asset is. USDT aims to track $1, but counterparty and regulatory risks exist; diversify custody and keep records.

Is converting taxable?

Depends on your jurisdiction; many regions treat crypto-to-crypto swaps as taxable events — consult a professional.

What does BTC/USDT volatility look like?

The pair moves as BTC moves; USDT is the numeraire. In panic, spreads can widen — plan size and timing.

Final thoughts

A BTC to USDT converter isn’t just a panic button; it’s a precision tool for risk control, cash-like flexibility, and fast redeployment. If you’re preparing a move, check BTC price today to gauge momentum, then run the Bitcoin USDT calculator to see your expected stablecoin amount before you execute.