Because the regulatory environment is complicated, financial services firms and other companies still prioritise SEC compliance.

Complying with SEC rules and regulations is necessary for avoiding sanctions and lawsuits, and for assuring investors and stakeholders.

At the heart of effective compliance are thorough policies and a proactive approach, including clear guidelines for maintaining SEC regulatory adherence that integrate seamlessly into daily operations.

Establish a Culture of Compliance With Clear Policies

Thus, it is critical to have well-designed policies and procedures that are clear and simple, easily available to all employees.

Your policies and procedures are the core of your regulatory system, explaining what a company needs to do to meet regulatory obligations, such as SEC mandates on disclosures, insider trading, and recordkeeping, among others.

- Use plain language to avoid confusion.

- Review and update policies regularly to keep up with evolving regulations.

- Ensure policies cover high-risk areas identified through periodic risk assessments.

Embedding these policies into the company culture encourages employees at every level to take ownership of compliance responsibilities.

Invest in Technology for Compliance Efficiency

SEC filings and disclosures present a large and difficult compliance issue.

Advanced compliance technology can automate routine compliance activities to minimize human error and provide real-time oversight in compliance efforts.

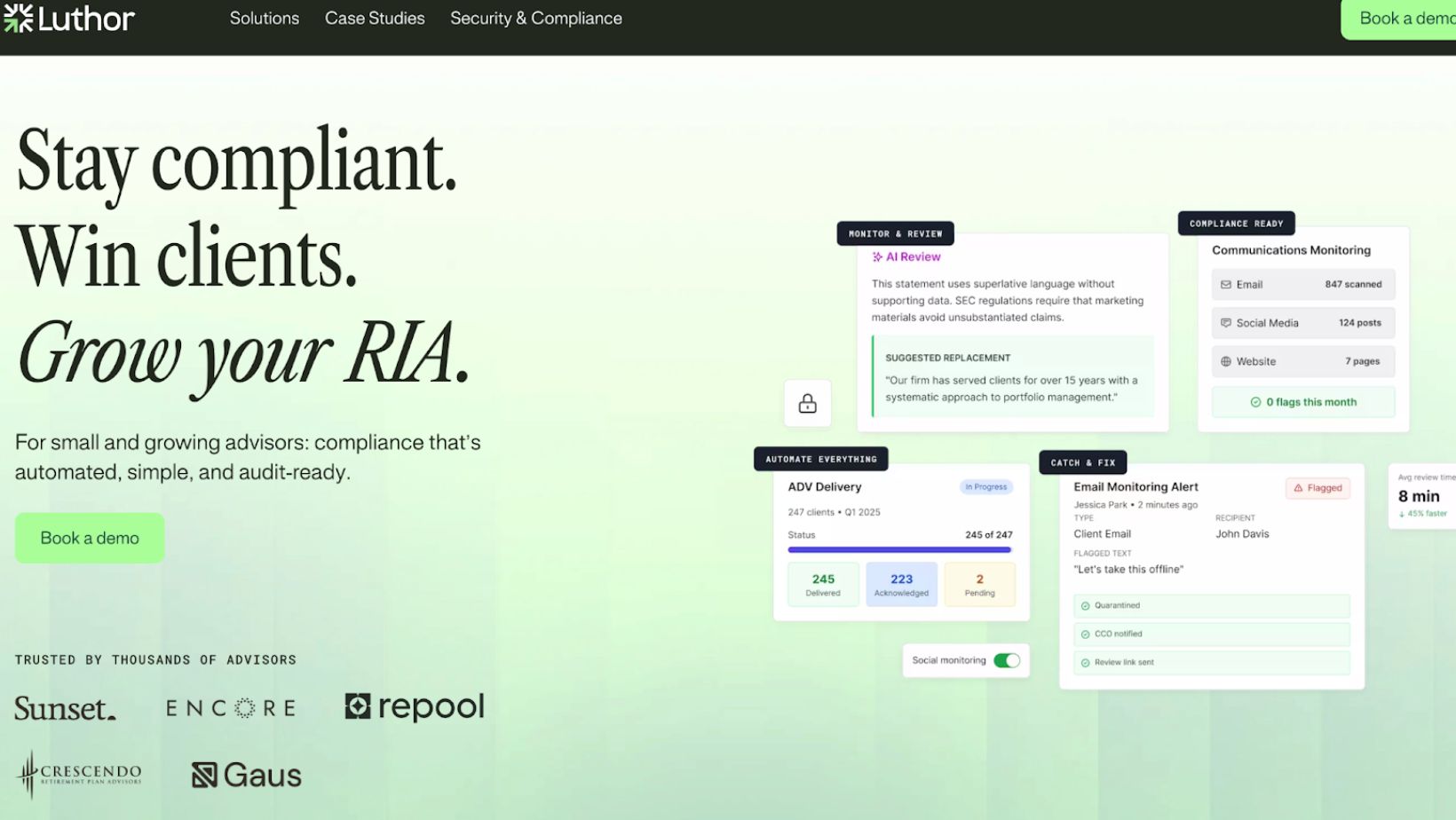

Tools like luthor.ai offer AI-driven document analysis and workflow automation that can help:

- Streamline preparation and review of SEC reports

- Enhance error detection before submission

- Facilitate secure recordkeeping and audit trails

Adopting technology improves accuracy and efficiency while freeing up compliance teams to focus on higher-level risk management.

Conduct Regular Training and Communication

For the reason that people must actively comply, people need recurring meetings and training to update all employees on changes in regulations or their roles in the compliance program.

Training programs should fit the exact needs of departments and employee levels.

Compliance officers and employees who communicate well can ease questions and detect a potential problem early.

Perform Rigorous Reviews and Audits

Audit internally and review for compliance to check whether your compliance program has been implemented effectively, and identify gaps and weaknesses before an external audit or enforcement action occurs.

Key practices include:

- Annual compliance program assessments

- Mock filings to test data accuracy and timeliness

- Regular audits of electronic communications and recordkeeping

- Cross-departmental collaboration, especially between compliance, legal, finance, and IT teams

The insights gained enable continuous improvement and demonstrate a commitment to compliance discipline.

Prioritize Conflicts of Interest and Disclosure Accuracy

Regulators expect disclosures within all SEC filings to be clear and accurate, and firms should establish procedures for identifying, assessing, and managing conflicts of interest.

This requires:

- Comprehensive disclosure policies

- Ongoing monitoring of relationships that could create conflicts

- Careful oversight of investment adviser and broker-dealer disclosures

Ensuring disclosures accurately reflect the firm’s operations safeguards both investors and the company’s reputation.

Strengthen Recordkeeping and Communication Monitoring

Recordkeeping violations are a common regulatory penalty.

Firms must store and preserve during the required retention period all investor communications, financial statements, and other records required to be kept.

Monitoring of on-channel and off-channel communications, including emails, text messages, and social media, can assist in identifying violations of compliance rules.

Surveillance tools and policies can help the firm avoid penalties or enforcement actions because the firm’s records cannot be found by them, the firm’s records are missing in action, or the firm’s records are incomplete.

Implement Contingency and Incident Response Planning

System outages, hardware failures, or natural disasters outside the firm’s control can stop timely filing and compliance.

A firm can reduce the impact of these events by planning business continuity in detail.

These plans include procedures to file alternatively, plus communication protocols with the SEC or other regulators.

As a result, these plans have become increasingly important to allow for the timely reporting of breaches of sensitive data.

The Role of the Chief Compliance Officer (CCO)

Leadership from the Chief Compliance Officer is vital to align compliance strategy with business objectives and regulatory expectations.

The CCO oversees:

- Development and updating of compliance policies

- Coordination of training and audits

- Management of disclosure accuracy, including financial reporting and ESG matters

- Supervision of cybersecurity and anti-money laundering controls

Strong cross-functional collaboration ensures all departments contribute to a unified compliance effort.

Conclusion

Successful SEC compliance is based on a strong foundation of risk-based policy and procedure, education and training, technology solutions, and a strong process review.

Building a culture of accountability and transparency through the integration of your SEC regulatory compliance responsibilities at every level of your business is also critical.

New AI solutions, like luthor.ai, can assist in automating compliance tasks and better handle and review documents to help companies stay on top of their regulatory obligations.When companies understand and address these priorities for themselves, they can comply with programs that protect their interests and maintain the integrity of their markets and overall compliance structure.