Looking for a fast and efficient way to deposit checks without visiting the bank? Utilize mobile check deposit, a banking app feature that allows you to remotely deposit a check into your checking or savings account.

Here are the benefits of mobile check deposits and how to use them:

Benefits of Mobile Check Deposits

Mobile check deposits offer numerous benefits, such as:

- Greater Flexibility: Imagine depositing a check into your account from anywhere in the world. With mobile deposits, you don’t have to go to a bank or ATM. The service is available 24/7, allowing you to cash a check online as soon as you receive it.

- More Savings: Mobile check deposits mean fewer bank trips, saving you time and gas. They are ideal for small businesses that don’t have the resources to take checks to the bank.

- Efficient Record Keeping: Every time you submit a check online, your banking app creates a time-stamped digital record of your deposit. As a result, you can review expenses and transfers at the end of each month. Efficient record-keeping is the building block for financial management.

- Minimal Risk: Most banks set daily or monthly check deposit limits to reduce potential risks. They also monitor your mobile check deposit activity. If anything appears suspicious, your bank will contact you for confirmation.

- Advanced Security: Financial institutions use advanced encryption technologies when processing your check images online, protecting your payment from fraud and other scams. Moreover, many bank apps use multi-factor authentication to verify your identity and protect your personal information.

How to Use Mobile Checks

The process of depositing a mobile check is straightforward. Follow these steps for a hassle-free experience:

Step 1: Log Into Your Bank Account

Mobile check deposits occur through your bank’s mobile app. Sign up or log into your bank’s app. Find the mobile deposit feature.

Step 2: Sign Your Check

Review the check you’ve received and make sure it isn’t expired. Flip the check over and sign your name. Some banks require you to write “For mobile deposit only” or check a box for an added layer of protection.

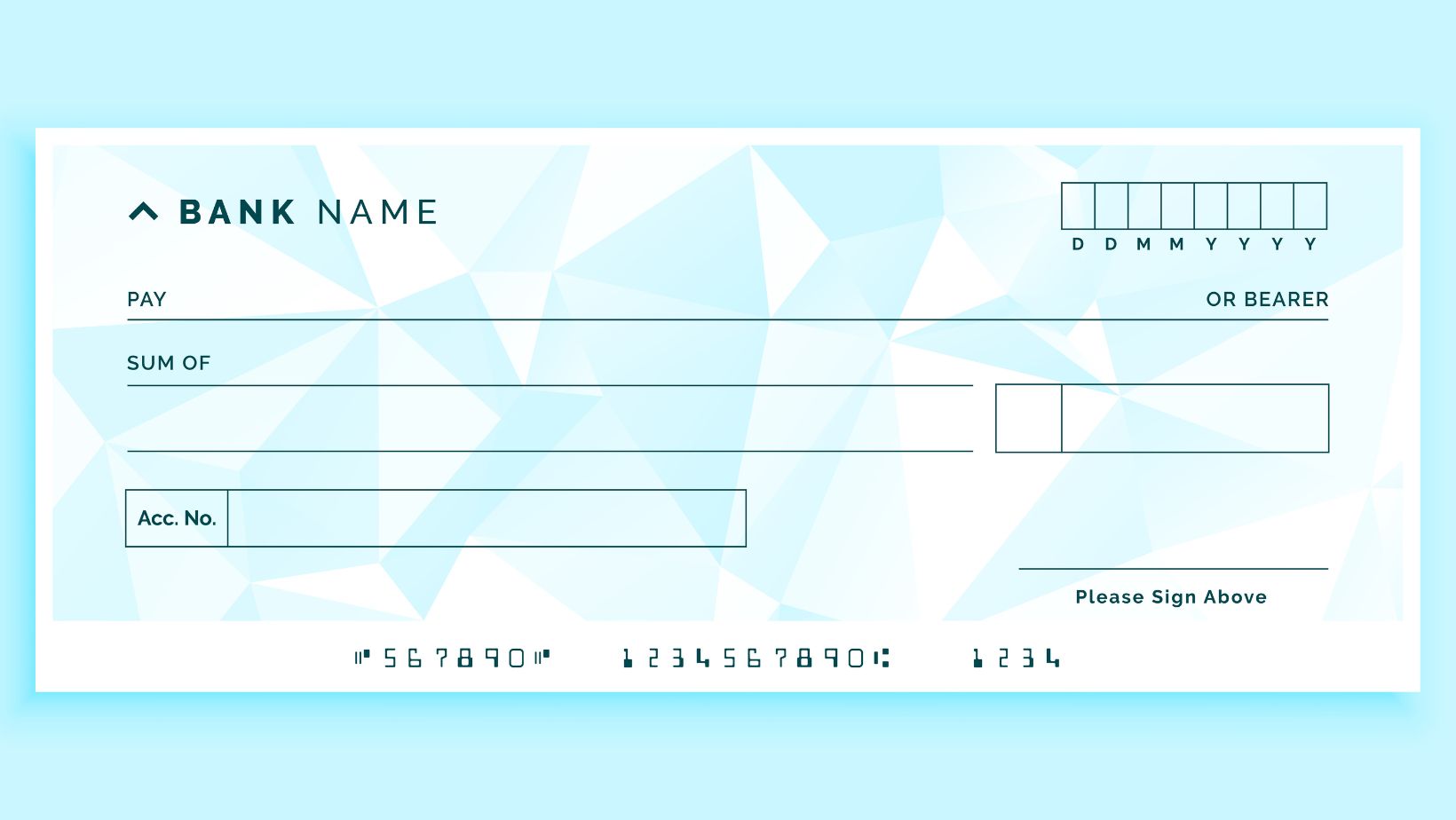

Step 3: Take Pictures

Take pictures of both sides of your check. Lay it flat on a clean surface and make sure there aren’t any shadows.

Center the check in the frame so all four corners are visible, and your details are easy to read.

Step 4: Verify Deposit Details

Once the photos are submitted, the banking app will ask you to type in the deposit amount. If it doesn’t match the amount written on your check, the bank will reject your deposit.

Step 5: Submit the Check

Review the information again and submit the check. You’ll receive confirmation via email, message, or both.

Step 6: Keep Track

Mobile check funds are available within 1-5 business days. Don’t discard the check immediately after receiving the funds. Instead, keep the check in a safe place for at least 14-30 days. Always shred the check to avoid any security risks.

Mobile check deposits have simplified financial management. They are fast, secure, and easy to process.