Trailing stop orders are an advanced type frequently used by traders in more complex strategies or with less time to survey the markets. They help traders minimize losses and maximize profits by enabling a trade to remain open and profit until the price moves in the desired direction.

A trailing stop can be set as a percentage or fixed amount, depending on your needs and

preferences. A rate can help you reconcile price changes across different securities, while a designated stop can be more precise and easier to manage with a simple click.

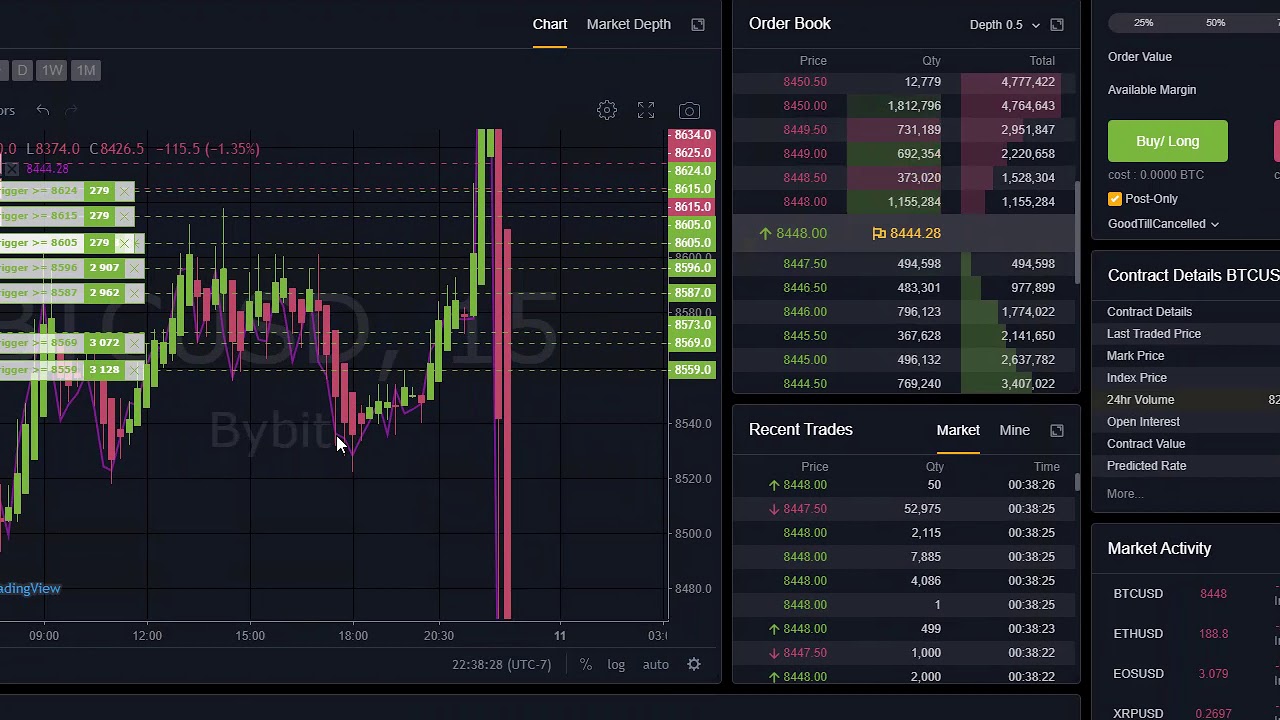

Bybit supports a variety of trading products and order types, including limit orders, market orders, and conditional orders. This wide range of options allows users to diversify their strategies, engage in different market segments, and manage their risk exposure more effectively.

AI Strategy Designer

The Bybit app supports the AI Strategy Designer. This cutting-edge tool allows users to analyze real-time market conditions and determine which trading strategies are best suited for the current situation. This feature is indispensable for pro traders and Hero subscribers who want to make informed decisions, capitalize on market opportunities, and optimize their trading strategies.

Bybit Trailing Stop

A bybit trailing stop order enables traders to secure their gains in volatile markets by locking them in the current price of the asset until it changes direction or falls to a specified price level.

The order is triggered when the underlying asset moves in the preferred direction by a set percentage and will remain active until the price moves in the opposite direction.

Traders are encouraged to revise their trailing stop strategy from time to time to account for fluctuating prices. This can be especially important during times of volatility when traders are more likely to experience significant losses if they have too tight of a trailing stop.

Trailing stops can be effective in most market conditions if they are placed in the correct settings

and are matched to your risk tolerance. However, they can also cause significant losses if they are not set correctly or in the right market conditions.

For a trailing stop to be effective, the stop’s delta and activation price should not be too small or too large. When either of these values is too small or too close to the entry price, it is easy for a trailing stop to be triggered by regular daily market movements and close/exit a trade at a point where the price just took a temporary dip and then recovered, resulting in a losing trade.

In the case of an overly tight trailing stop, it can be triggered by a temporary pullback in the market that is not supported by the trader’s risk tolerance or investment experience. This can result in significant losses that are difficult to cope with psychologically and can lead to traders exiting their positions prematurely or putting a stop-loss too tight on a stock that is garnering support.